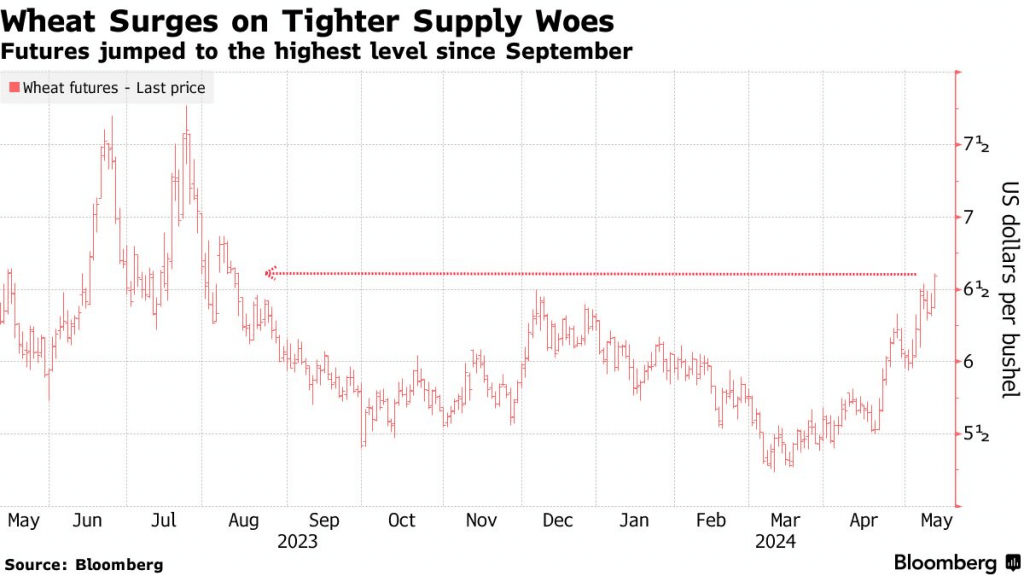

Wheat Prices Rally to 9-Month Highs, Adding to Inflation Woes

Suboptimal growing conditions have pushed down forecasts for the 2024-2025 wheat harvest, which has in turn pushed up prices

- Wheat futures rallied by roughly 30% since mid-March, as suboptimal growing conditions scaled back expectations for the 2024-2025 harvest.

- Prices moved higher for other agricultural commodities—such as corn and soybeans—but at a slower pace than wheat prices.

- Rising wheat prices are adding to inflation concerns, because the prices of other food-related commodities—such as milk, cheese and orange juice—also advanced in recent weeks.

Inflation has been near the top of Wall Street’s “wall of worry” since early 2022, and based on recent activity in the wheat market, it’s going to remain there for a while longer.

Since bottoming in March of this year, wheat prices have been on a tear over the last eight weeks. A bushel of wheat now costs $6.85, which represents a nine-month high in prices. After rallying by about 30% since the March bottom, wheat prices are now in sight of a fresh 52-week high. Over the last year, wheat prices have ranged between roughly $5.20 and $7.20 per bushel.

Not surprisingly, some of wheat’s close agricultural cousins—corn and soybeans—also rose in value in recent weeks. But neither has kept pace with the torrid wheat market. Corn is trading at about $4.70 per bushel, which represents an increase of about 15% from the low of the year. Over the last 52 weeks, corn prices have ranged between about $4.00 and $6.00 a bushel.

The rally in soybean prices has been far more moderate than in the wheat and corn markets. Soybeans are currently trading at about $12.20 per bushel, which is only about 7% higher than the low of 2024. Over the last 52 weeks, soybean prices have ranged between roughly $11.50 and $14.50 per bushel.

Wheat prices have benefited from chilly spring weather in Russia

Global supply-demand dynamics typically drive agricultural commodity prices. For example, when the global economy is growing, commodities usually enjoy robust demand. In 2024, however, global growth has been relatively weak, which means surging demand for wheat hasn’t been the primary driver of higher prices.

Instead, wheat prices appear to be rising because of supply-side dynamics. For example, chillier-than-expected spring temperatures in Russia contributed to subpar growing conditions. On top of that, a lack of rainfall in Russia negatively impacted crop forecasts.

As a result of the situation in Russia, USDA World Agricultural Supply and Demand Estimates (WADE) now indicates Russian production during the 2024-2025 season will clock in about 3.5 million tons lower than last year. This effectively represents the opposite situation from 2023, when ideal growing conditions produced a bountiful harvest in the Russian Federation.

As noted recently by DTN analyst Todd Hultman, “The bottom line is, it comes back to Russia. Are they going to be able to have a big enough crop again this year to dominate world exports and hold prices down, or not?” DTN is a data and analytics company that provides news, analysis and weather intelligence for the commodities sector. The company maintains a large network of weather stations and is well known for highly accurate meteorological forecasts.

SovEcon—an agricultural research firm in Russia—recently corroborated the USDA forecast. SovEcon lowered its expectations for Russian wheat production during 2024-2025. The firm now expects a total harvest of around 89.5 million tons, which is about 3.4 million tons less than last year.

Speaking to subpar growing conditions in southern Russia, Andrey Sizov, the head of SovEcon said: “The past two months have seen a significant downturn in weather conditions, including abnormal warmth, drought and recent frosts.”

Dry growing conditions continue in the United States

The United States is another of the world’s largest wheat producers. In an average year, global producers harvest between 770 and 800 million tons of wheat, of which about 90 million tons are attributable to Russia, and about 50 million tons are attributable to the United States.

Two of the world’s other large producers are China and India, each of which harvests more than 100 million tons of wheat per year. Last year, China produced roughly 137 million tons of wheat, while India produced 110 million tons of wheat.

This year, the global harvest is expected to clock in at around 789 million tons, according to AgResource. Importantly, when it comes to the export market, the largest players are Russia, the European Union and the United States, which together export more than 100 million tons of wheat annually.

The export market is a key driver of prices because buyers from non-growing regions compete for available supply. And when the supply side tightens up, as has been the case in 2024, prices usually rise.

EU production to fall

Notably, growing conditions in the United States are also expected to be suboptimal in 2024. At present, the United States Department of Agriculture (USDA) expects overall wheat production to grow by only a small amount this year, rising by about 3%, to 51.7 million tons. In contrast, wheat production is expected to drop in the European Union, falling by about 2.2 million tons during the 2024-2025 growing season.

The uptick in U.S. production won’t cover the combined shortfall in output from the EU and Russia. Ultimately, that equates to a tighter supply-demand dynamic, which helps explain why prices have been moving higher. Bullish sentiment in the wheat market has also been supported by the fact that global wheat inventories (e.g. wheat in storage) have fallen toward the lowest levels observed in the last decade.

Milk, cheese and orange juice prices also rise

In addition to wheat, corn and soybeans, the prices of other food-related commodities have risen in recent weeks.

Over the last month, futures prices for milk, orange juice and cheese are up 21%. 14%, and 9%, respectively. And these price trends help illustrate why inflation has persisted during the first five months of 2024.

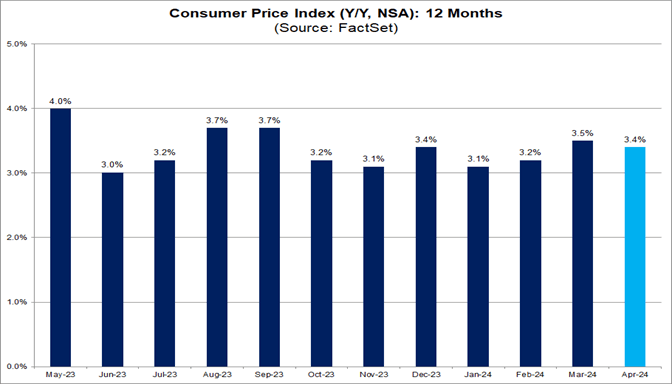

New data from the month of April shows that the consumer price index (CPI) rose by about 3.4% over the last 12 months. That’s down from the month prior, when CPI was 3.5%, but it’s still well above the Federal Reserve’s preferred target of 2%, as illustrated below.

Rising prices are clearly taking a toll on American consumers. A recent report from the University of Michigan showed consumer sentiment fell to a six-month low in May. The university’s the consumer sentiment index slumped to 67.4 in May, which was the lowest reading since last November. It was also well below the sentiment levels observed in April, when the index was closer to 77.

This shift is no doubt linked to the continuing effects of record inflation, which continues to plague American consumers.

Speaking to the negative effects of price inflation, Jacob Sprague—a systems engineer from Nevada—recently told The New York Times, “I’m paying more on taxes and more on groceries and more on housing and more on fuel. So that doesn’t feel good.”

Rising prices and slumping sentiment are especially pertinent given that it’s a major election year. No matter one’s political bias, it’s easy to see how further deterioration in consumer confidence could impair the incumbent (Joe Biden) and benefit the challenger (Donald Trump). The relative strength of the underlying economy has always been a vital determinant in major U.S. elections, and the 2024 contest probably won’t be any different.

To learn more about trading the wheat futures market, readers can check out this installment of Options Trading Concepts Live on the tastylive financial network. To access the agricultural commodities markets, readers can also consider ETFs such as the Teucrium Corn ETF (CORN), the Teucrium Soybean Fund (SOYB), and the Teucrium Wheat Fund (WEAT).

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.